FIN/S

Private Banking & Wealth Management

FIN/S

FIN/S for Private banking is an integrated, multi-lingual, multi asset-class, front-to-back solution for maximizing efficiency and attaining operational excellence. Secure and reliable, compliant to regulations (MiFID II, GDPR etc.), with a modern built-in Client Relationship Management module and a flexible Workflow configurator for the optimization of business flows, FIN/S provides state-of-the-art technology to allow financial institutions increasing their client service capabilities, reducing costs, and generating additional revenue.

FRONT OFFICE

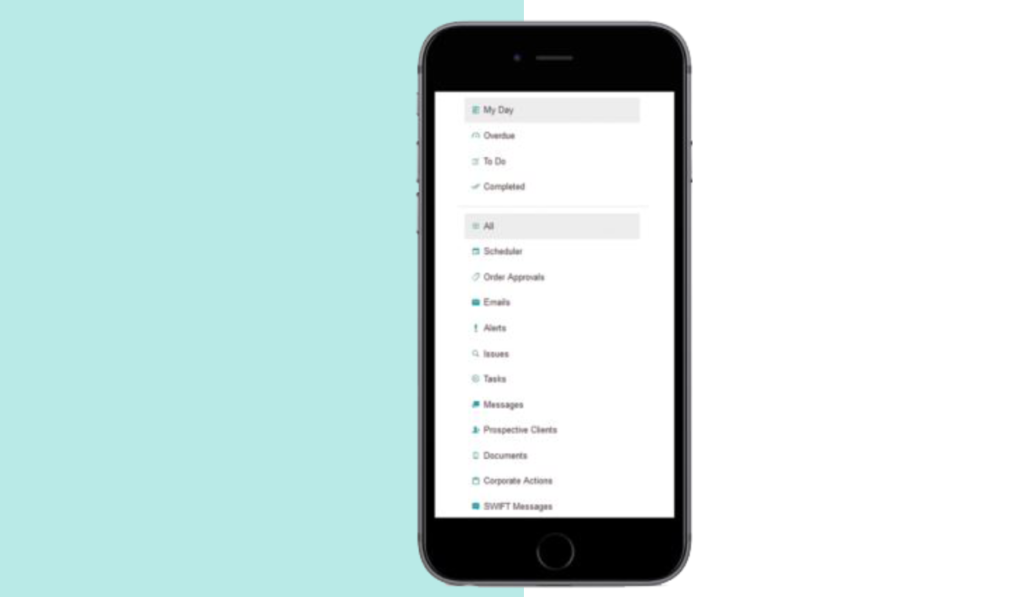

TO-DO

TO-DO

Through its “Welcome screen” FIN/S offers a consolidated overview of daily tasks, notifications, alerts or upcoming events. At the same time, through the "My Day" schedule, it organizes the daily tasks of the staff so that they are able to increase productivity and provide higher quality services to their clients.

Learn More

CRM

CRM

The Customer Management fully complies with the instructions MiFID II & GDPR, providing security to the Investment Advisor. Each client may own multiple portfolios through multiple agreements. He may be either the sole owner of a portfolio or a joint holder.

Personal data, contact details, the investment guidelines, the categories defined by the user and the pricing policy are directly available.

Learn More

Analysis and Reports

Analysis and Reports

FIN/S dashboards provide Management, Relationship Managers and Advisors with all necessary information regarding the clients under management in a modern and user-oriented way. Data are designed and presented in different schemes, such as crosstabs, pie charts, bar charts or gauges, offering an overall view of the clients and the investment instruments, while drill down processes and reporting tools. Furthermore, KPI’s provided offer important statistics that are useful for management purposes

Learn More

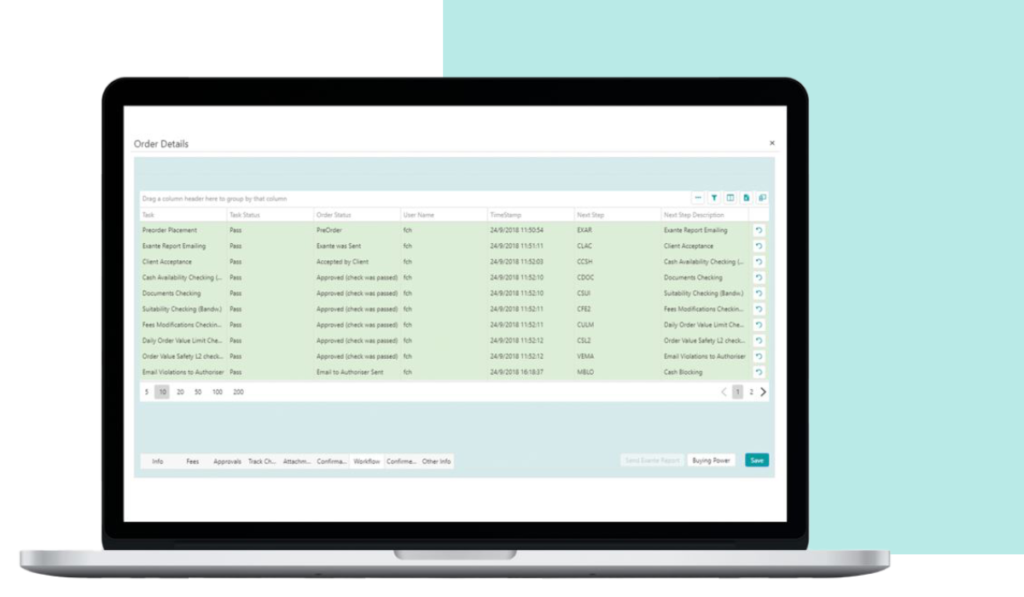

Order Management

Order Management

FIN/S order management system simplifies order life-cycles, from order placement to execution and settlement, based on Straight-through processes and customizable workflows. It is designed to be simple and efficient while covering a wide range of investment instruments, client pricing policies, multi-broker relationships and multi-currency needs.

Learn More

MIDDLE OFFICE

Risk Management

Risk Management

The FIN/S includes a built-in risk management system, includes algorithms for the calculation of Value at Risk (VaR).The system provides appropriate, documented and regularly updated process in compliance with the objectives, the investment strategy and the regulatory authorities. With the FIN/S Risk management system the officers can identify, measure and monitor all risks relevant to each investment strategy.

Learn More

Investment Strategies

Investment Strategies

FIN/S has the ability to record and classify investment proposals for each Firm, based on client categories. The investment proposals are classified based on clients’ categories. including the financial products, the action to be taken, the value of the portfolio, the risk factors, the client's information, the creator of the proposal, etc.

Learn More

BACK OFFICE

![]()

Post Trade

-

Transaction Processing & History

-

Complex calculations of Commissions & Fees

-

Account and Cash Management

-

Periodic Fees Calculations

-

Evaluation of Positions and Accrued

-

Indexes & Benchmarks Design

-

Partnership Accounting

Learn More

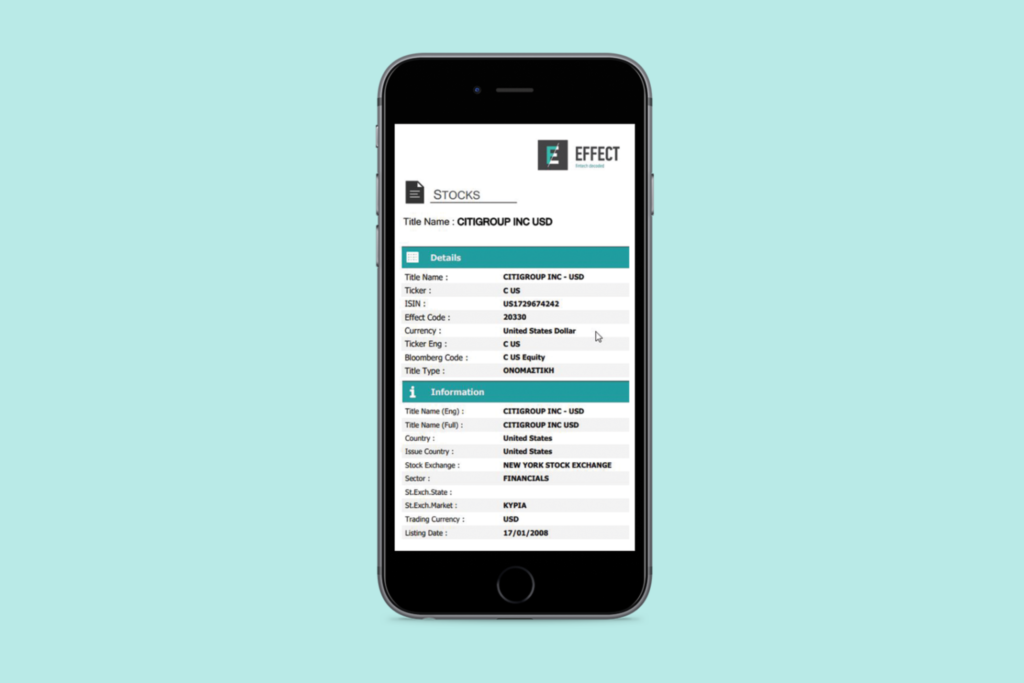

Investment Products Management

Investment Products Management

All the details of any investment instrument are kept under this section. Through Investment Products Management, the organization monitors any type of investment products that may be included in a Portfolio.

Coupon payment periods for bonds and other similar products are being set up, while all the information of any corporate action is kept in specific flexible forms.

Learn More

Corporate actions

Corporate actions

FIN/S fully automates complex tasks that involve corporate actions, dealing with them in a uniform and extremely simple and user friendly way. All corporate actions for all types of products are handled through the same process, which provides complete control and eliminates the possibility of errors.

Learn More

Fees & Charges

Fees & Charges

EFFECT Fees module offers fully

parametric platform for fees

management, taxes, expenses and other charges

which is applying calculations

of any kind in any currency.

Respectively it calculates periodic fees

(custody, management, and performance fees)

based on the specific agreement of each client

automatically generates billing transactions for

each portfolio and issues invoices.

Learn More

Periodic Reporting

Periodic Reporting

The system can provide every kind of statement

for active Portfolios. The Reporting Currency

to be used is applied per Portfolio

and/or per Client. All details on

frequency and means of sending the statement are

set on the system per Portfolio.

All statement can be easily

translated to any required language.

Learn More

SWIFT engine

SWIFT engine

System’s SWIFT engine is highly parametrical and is designed so as to support any SWIFT messages MT5**. In this way it can recognize and produce different messages, covering the company’s workflow of the company.

Learn More

Accounting

Accounting

EFFECT FIN/S delivers a comprehensive built –in Accounting module, fully integrated with middle and back office operations, that helps companies to streamline business operations and accelerate demanding accounting needs. Companies can maintain a broad range of accounting entries generated from secure and dependable processes thanks to the single database approach.

Learn More

MANAGEMENT

Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs)

EFFECT FIN/S offers several KPI’s that help Investment Management firms monitor their business metrics in terms of client and investment performances and also have a clear insight of the company’s efficiency. In modern dashboards and reports, managers can review their KPI’s against their business objectives and goals.

Learn More

AUDITING & COMPLIANCE

Audit trails

Audit trails

All of the executed transactions and actions are logged in an audit trail, available to the security officer. The date and time of the transaction are logged in every case, as well as the user, and the computer id that has executed the transaction. If the action is a modification, the transaction details before and after the change are recorded. The audit trail is secured and it cannot be modified in any way by any user.

Learn More

Alerting &

emailing

FIN/S online alerts subsystem works in the background, by utilizing the system’s multi thread processing, performing real time analysis and generating alerts and notification emails according to user predefined parameters and targets.

Learn More

ADMINISTRATION

Workflow designing

Workflow designing

FIN/S is established with a powerful workflow engine so as to streamline all business processes with easy-to-create workflows. It provides all the major features that managers and officers need so as to be efficient in their daily tasks while at the same time it reduces operational and settlement risks. Authorized users have the ability to draw as many workflows as they require, in a simple and straightforward process, without any technical intervention.

Learn More